As America’s aging population continues to grow, families across the country are looking for compassionate, reliable, and flexible care solutions for their loved ones.

One increasingly popular choice is in-home senior care. But one of the most common and pressing questions families face is: How Much Does In Home Senior Care Cost?

Understanding the full range of in-home senior care cost factors is critical for making informed decisions, preparing financial resources, and ensuring seniors receive quality care without placing undue stress on the family.

This comprehensive guide breaks down the key components that make up the cost for home senior care. From hourly, daily, and monthly rates to annual projections, we cover what you can expect to pay. We also explore affordable senior personal care solutions, free home health care for seniors, and how to pay for care through insurance, government programs, and alternative financing.

Why In-Home Care Is the Preferred Choice for Many Seniors

Being able to age in your own home offers comfort, continuity, and a sense of independence. Unlike assisted living or nursing homes, in-home care allows seniors to remain in familiar surroundings with support tailored to their needs.

This personalized approach not only enhances emotional well-being but also gives families peace of mind.

However, the home senior care cost can vary widely, depending on many different factors, so knowing what to expect can help avoid financial surprises.

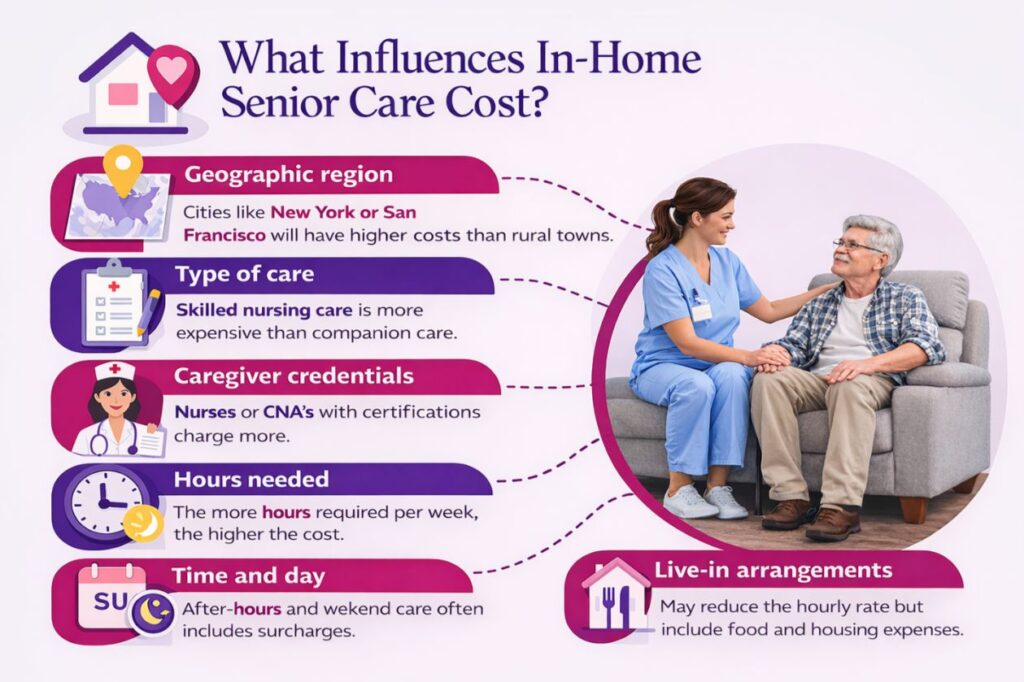

What Influences In-Home Senior Care Cost?

Understanding what drives the in-home care pricing can help families create a plan for caring for seniors at home. Here are the most common factors:

- Geographic region: Cities like New York or San Francisco will have higher costs than rural towns.

- Type of care: Skilled nursing care is more expensive than companion care.

- Caregiver credentials: Nurses or CNA’s with certifications charge more.

- Hours needed: The more hours required per week, the higher the cost.

- Care complexity: Alzheimer’s or Parkinson’s care may require specially trained aides.

- Time and day: After-hours and weekend care often includes surcharges.

- Live-in arrangements: May reduce the hourly rate but include food and housing expenses.

Every care plan is different. A tailored assessment will help you better estimate your specific home senior care cost.

Benefits of In-Home Senior Care

Beyond the financial considerations, the advantages of in-home senior care are extensive and deeply impactful, offering emotional, physical, and psychological benefits to both seniors and their families.

Here are several key reasons why many choose this model of care:

- Personalized and Flexible Care Plans: In-home caregivers can tailor their support to a senior’s individual needs, preferences, and daily routine. Care can be easily adjusted as those needs evolve over time.

- Enhanced Independence: Seniors receiving care at home are empowered to continue participating in familiar daily activities, maintaining a greater level of autonomy and control over their environment.

- Comfort and Familiarity: Remaining at home helps reduce confusion and anxiety, especially for seniors with cognitive conditions like Alzheimer’s or dementia. The stability of a known setting provides emotional grounding.

- One-on-One Attention: Unlike facility care where staff may serve many residents, in-home care ensures personalized, undivided attention that supports better outcomes and fosters stronger bonds between caregivers and seniors.

- Continuity and Companionship: Regular companion care visits build trust, companionship, and emotional support. Seniors often form meaningful relationships with their caregivers, reducing feelings of loneliness and isolation.

- Fewer Hospital Readmissions: Studies show that seniors who receive appropriate in-home care are less likely to be readmitted to the hospital due to better monitoring, medication adherence, and early detection of health concerns.

- Involvement of Family Members: Home care makes it easier for family members to remain involved in day-to-day care, enabling better communication, oversight, and participation in their loved one’s well-being.

- Safe and Controlled Environment: Care at home minimizes exposure to illness and infection that may be more prevalent in communal settings such as nursing homes or assisted living facilities.

- Cost Management Through Care Customization: Families can choose the number of hours or services needed, which allows better control over costs while still providing essential support.

These multifaceted benefits explain why in-home senior care remains a preferred and growing option for families across the country.

How Much Does Private Home Care Cost Per Hour?

The most common way to evaluate the cost of in-home care is by the hour. The national average for private home care ranges between $20 and $40 per hour, with most families paying around $30 to $33 per hour.

Hiring a caregiver through an agency provides added services like background checks, payroll management, and scheduling backups.

However, a senior home care business may charge more than a private caregiver, ranging from $33 to $40 per hour nationally. In contrast, hiring a private caregiver independently may cost around $25 – $30 per hour. Hiring privately requires the family to manage employment responsibilities.

So, how much does private home care cost per hour? On average, expect $30, but this could rise to $40 or more for skilled healthcare workers in high-cost areas.

How Much Does In-Home Care Cost Per Month?

Families often budget on a monthly basis, and naturally ask what the in home senior care cost will be per month.

The answer depends on the number of care hours per week and the hourly rate. Below is a sample breakdown assuming a $30 hourly rate:

| Weekly Hours | Monthly Cost |

| 20 hours/week | $2,400 |

| 40 hours/week | $4,800 |

| 60 hours/week | $7,200 |

| 84 hours/week | $10,800 |

| 24/7 live-in care | $18,000+ |

As seen above, the home senior care cost can vary significantly based on the level of care required. Round-the-clock assistance can surpass $20,000 per month if provided by multiple professional caregivers.

Cost of Home Health Care Annually

To better prepare for long-term care, it helps to understand the annual cost of home health care. The following projections are based on average national rates for 2025 assuming a $30 hourly rate:

- Part-time care (20 hrs/week): $31,200/year

- Full-time care (40 hrs/week): $62,400/year

- High-need care (60 hrs/week): $93,600/year

- Live-in care (24/7): $216,000–$250,000/year

These figures highlight why it’s important to research financial options and explore affordable senior home care programs to manage costs.

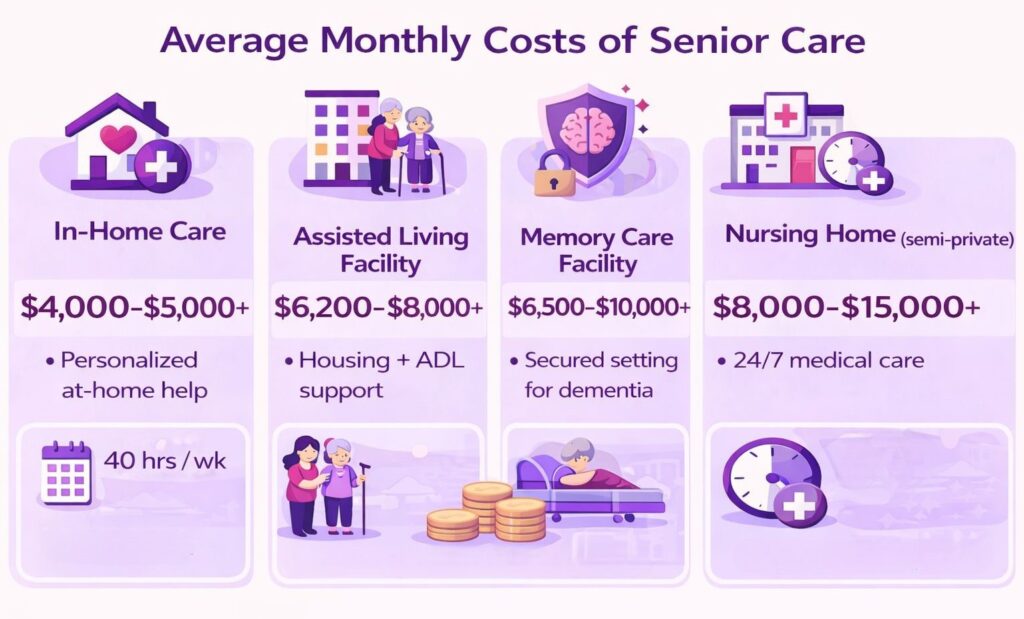

Comparing Home Care to Assisted Living and Nursing Homes

To evaluate if in-home care is the right solution, families often compare it with other senior care options:

| Care Setting | Monthly Cost (avg) | Type of Care |

| In-Home Care (40 hrs/wk) | $4,000 – $5,000+ | Personalized at-home help |

| Assisted Living Facility | $6,200 – $8,000+ | Housing + ADL support |

| Memory Care Facility | $6,500 – $10,000+ | Secured setting for dementia |

| Nursing Home (semi-private) | $8,000 – $15,000+ | 24/7 medical care |

In-home care can be the more cost-effective and comfortable solution when only part-time help is needed.

(Note, these prices are broad averages for senior care around the United States. Monthly costs will vary from state to state. With states like California, New York, Alaska, etc being at the upper end.)

Options for Affordable Home Care for Seniors

Finding affordable home care for seniors can feel overwhelming, but many options exist:

- Hire independently: Reduces costs but increases responsibility

- Start with part-time care: A few hours per week can provide meaningful support.

- Use adult day services: Lowers home care hours needed

- Schedule split care: Share responsibilities with other family members

- Apply for grants or community programs: Many states offer financial assistance

- Check for volunteer or sliding-scale services: Often found at nonprofits, faith organizations, or local senior centers

Affordable home senior care services are within reach with thoughtful planning and a mix of public and private resources.

Free Home Health Care for Seniors

Many families search for options to lower or eliminate the cost of care. Fortunately, free home health care for seniors is available through several programs:

- Medicaid Home and Community-Based Services (HCBS): Covers in-home help for qualifying low-income seniors through HCBS

- Veterans Affairs (VA): Offers aid for eligible veterans and spouses via Homemaker/Home Health Aide Program and Aid & Attendance benefit

- Medicare PACE (Program of All-Inclusive Care for the Elderly): Covers all necessary medical and support services for seniors who qualify for nursing home care but can remain at home

- Local Agencies on Aging (AAA): Connects seniors to low-cost or volunteer-based services

- Nonprofits and volunteer caregiver services: Often provide companionship, errands, and light household help

Eligibility usually depends on income, medical need, and age, so start by contacting your local senior services agency.

Does Medicare Cover Home Health Care?

The answer is yes, but there are some limitations. Here is a breakdown of things to consider.

Medicare does cover:

- Skilled nursing care (short-term)

- Physical, occupational, or speech therapy

- Part-time home health aide assistance

- Medical social services

Requirements:

- Doctor must prescribe the services

- Patient must be homebound

- Care must be provided by a Medicare-certified agency

Medicare does not cover:

- 24/7 in-home care

- Personal care only (bathing, dressing, housekeeping) without skilled care

- Meal delivery, cleaning, or transportation

Understanding what is and isn’t covered helps families plan how to cover the remaining cost of home health care.

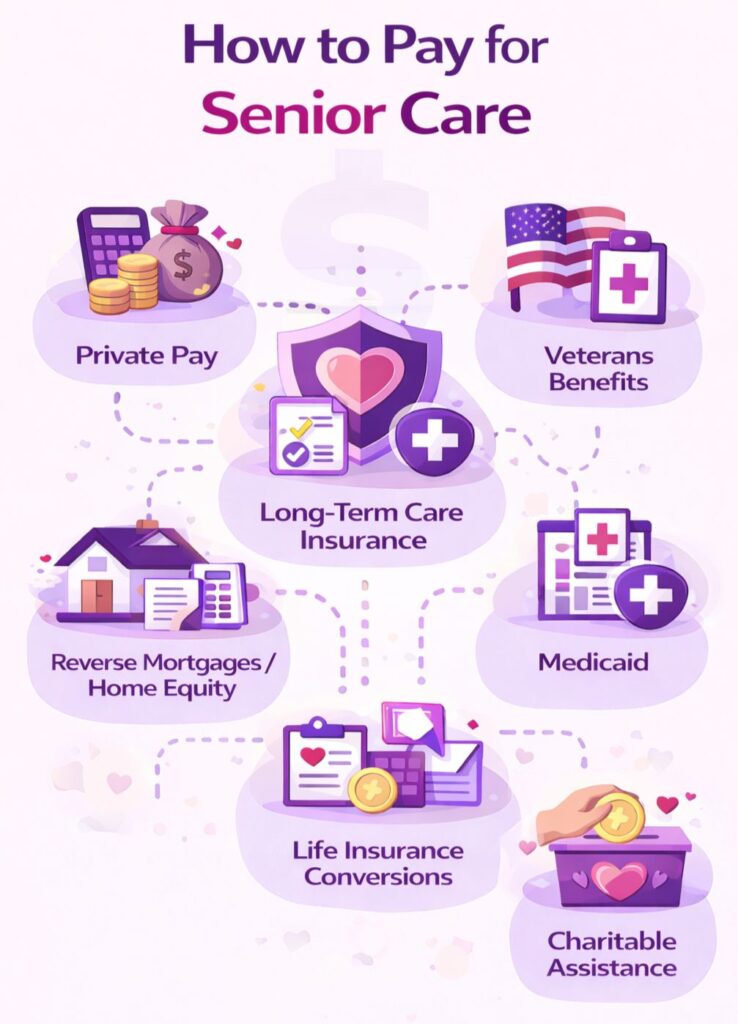

How to Pay for In-Home Senior Care

Paying for care often requires a multi-source strategy. Let’s review the most common methods:

1. Private Pay

The most flexible option, covering costs with savings, pensions, or family contributions. Useful for part-time or short-term care.

2. Long-Term Care Insurance

LTC policies are specifically designed to pay for extended care needs, whether at home or in facilities. Long term care insurance policies can help cover in-home care when certain conditions are met. Check benefit limits, elimination periods, and eligibility requirements.

3. Medicaid

Covers in-home support for those who meet financial and medical need criteria. Many states offer waivers to pay for personal aides and homemakers.

4. Veterans Benefits

The VA Aid & Attendance benefit and the Homemaker/Home Health Aide Program offer substantial help for veterans and spouses.

5. Reverse Mortgages/Home Equity

Homeowners can access home equity through a reverse mortgage or line of credit to fund care. Seek financial advice to evaluate long-term impact.

6. Life Insurance Conversions

Some policies allow accelerated benefits or conversion into long-term care payouts.

7. Charitable Assistance

Many organizations offer sliding-scale fees, caregiver stipends, or in-kind services for seniors in need.

By using these payment methods together, families can often cover the in-home senior care cost more easily than expected.

Additional Tips for Managing Home Care Expenses

- Create a care budget: Project future costs based on hours per week

- Reassess regularly: Needs change over time; update the care plan accordingly

- Explore local resources: Use your area’s Agency on Aging or Eldercare Locator

- Look for caregiver tax breaks: Some expenses may qualify for tax deductions

- Join support networks: Online forums and caregiver groups often share cost-saving tips

FAQ: In-Home Senior Care Cost

Q: What affects the cost of home senior care?

A: Key factors include location, care type, caregiver qualifications, and hours needed.

Q: Can I find affordable home care for seniors?

A: Yes. Through part-time help, family support, nonprofit programs, and Medicaid.

Q: Are there programs offering free home health care for seniors?

A: Medicaid, VA services, PACE, and some nonprofits offer free or reduced-cost care.

Q: Does Medicare cover home health care?

A: Medicare covers short-term skilled care, but not long-term custodial care.

Q: What are the best ways to pay for in-home senior care?

A: Combine private pay, long-term care insurance, Medicaid, VA benefits, and home equity.

Q: Can family members be paid to provide in-home senior care?

A: In some states, Medicaid allows family members to be compensated for caregiving through consumer-directed programs. Eligibility and rules vary by state.

Q: What types of services are included in in-home senior care?

A: Services often include help with bathing, dressing, meal preparation, medication reminders, mobility support, light housekeeping, companionship, and transportation.

Q: Is in-home senior care available for people with dementia?

A: Yes, many caregivers are trained in Alzheimer’s and dementia care. Some agencies specialize in memory care support delivered at home.

Q: How can I find a trustworthy caregiver or agency?

A: Ask for referrals from healthcare providers, check online reviews, verify licensing and certifications, and schedule interviews to evaluate experience and personality fit.

At Happier at Home, we can help you find the right fit for your caregiving needs.

Q: What legal or employment responsibilities do I have when hiring a private caregiver?

A: If you hire privately, you may be considered an employer and must handle payroll taxes, insurance, and labor law compliance. Home health care agencies manage these details for you.

In-Home Care Cost Analysis

The question of how much does it cost for in-home senior care? is one every family must answer when planning for a loved one’s future.

As we’ve seen, costs can range from a few thousand dollars per month for part-time care to over $200,000 per year for continuous 24/7 assistance.

However, with smart planning, research, and use of available resources, it is possible to create a care plan that supports both the senior’s well-being and the family’s financial stability.

Start with an honest assessment of care needs, create a realistic budget, and don’t hesitate to seek professional help when evaluating funding options.